ما الذي يحتاجه التجار الهنود من شركة دعم في عام 2025؟

يواجه المتداولون الهنود تحديات فريدة: لوائح SEBI الصارمة ورأس المال المحدود والحاجة إلى منصات تتوافق مع ساعات السوق المحلية والمعاملات القائمة على INR. يجب أن تقدم أفضل شركات الدعم للمتداولين الهنود في عام 2025 ما يلي:

- تقييمات منخفضة التكلفة: دخول ميسور التكلفة إلى الحسابات الممولة.

- قواعد تداول مرنة: دعم المضاربة والتحوط وتداول الأخبار خلال الجلسات المتقلبة مثل التداخل بين لندن والهند.

- أصول متنوعة: الوصول إلى USD/INR و NIFTY 50 والعملات المشفرة والسلع.

- دفعات صديقة للبيئة: عمليات سحب سريعة عبر منصات مثل Wise أو Payoneer.

- منصات متقدمة: أدوات سهلة الاستخدام مثل TradeLocker أو MT5، محسّنة للبنية التحتية للإنترنت في الهند.

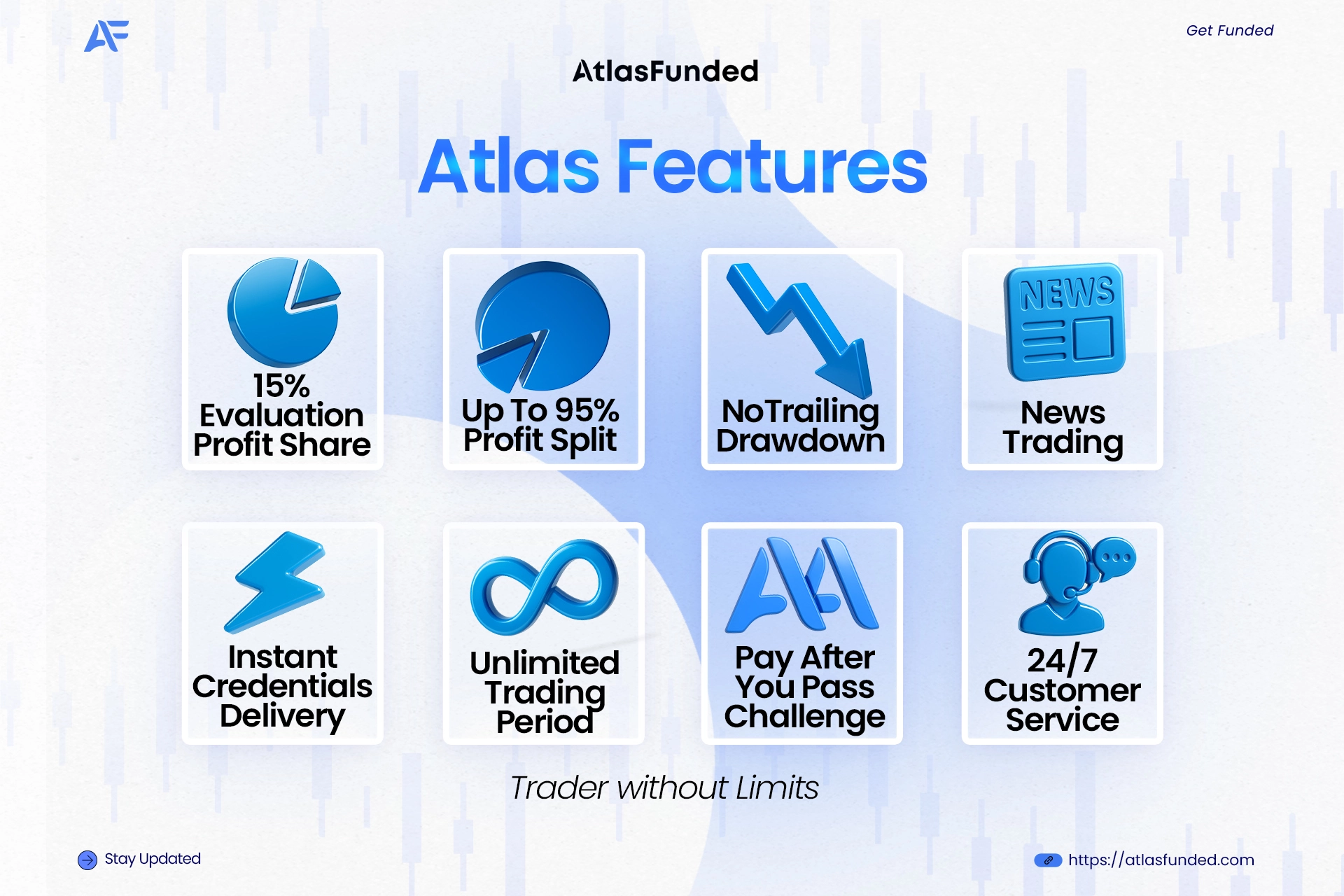

تعالج Atlas Funded هذه الاحتياجات من خلال نموذج يركز على المتداول، مصمم خصيصًا للنظام البيئي المالي المتنامي في الهند، كما يتضح من تصنيف TrustPilot البالغ 4.8+ والدعم المجتمعي النشط.

لماذا تعتبر شركة Atlas Funded من أفضل شركات الدعم للتجار الهنود

تحديات ميسورة التكلفة ويمكن الوصول إليها

يمكن أن تكون رسوم التقييم المرتفعة حاجزًا أمام المتداولين الهنود. يبدأ تحدي Single Helix من Atlas Funded من 4,800 دولار (59 دولارًا) لحساب 5,000 دولار، مع هدف ربح بنسبة 10٪ وبدون حدود زمنية. تحدي Pro، الذي يتطلب ربحًا بنسبة 5٪ في 10 أيام، يناسب المتداولين ذوي الخبرة. تتناقض هذه التقييمات منخفضة التكلفة المكونة من خطوة واحدة مع المنافسين مثل FundedNext، الذين غالبًا ما يستخدمون نماذج من خطوتين برسوم أعلى. على سبيل المثال، اجتازت التاجر الهندي بريا تحدي Single Helix في 15 يومًا، مستفيدة من الدخول منخفض التكلفة للوصول إلى حساب بقيمة 25,000 دولار.

شروط تداول مصممة للأسواق الهندية

تدعم شركة Atlas Funded المتداولين الهنود من خلال:

- أصول متنوعة: تداول الفوركس (USD/INR، EUR/INR)، العملات المشفرة (BTC/USD، ETH/USD)، NIFTY 50، والسلع.

- رافعة مالية عالية: ما يصل إلى 50:1 للفوركس و 5:1 للعملات المشفرة، وهو مثالي لجلسات السوق الهندية المتقلبة.

- لا توجد قيود: يُسمح بالمضاربة والتحوط وEAs وتداول الأخبار، بما يتماشى مع استراتيجيات تقلب الدولار الأمريكي/الروبية الهندية.

- فروق أسعار منخفضة: فروق أسعار في الفوركس تبدأ من 0.1 نقطة وعمولات العملات المشفرة بنسبة 0.024٪.

- منصة تريدلوكر: مدمج مع TradingView، مما يوفر تنفيذًا سريعًا ووصولًا متوافقًا مع الأجهزة المحمولة لتجار الهند.

هذه الميزات تجعل Atlas Funded مثاليًا للتغلب على القيود التنظيمية وفرص السوق في الهند.

لوحة تحكم خاصة للتداول الاستراتيجي

تتطلب أسواق الهند سريعة الوتيرة رؤى في الوقت الفعلي. توفر لوحة التحكم الخاصة بـ Atlas Funded تحليلات حية حول السحب وأهداف الربح وأداء التداول. استخدم المتداول Arjun المقيم في مومباي لوحة القيادة لتحسين استراتيجية NIFTY 50 الخاصة به، واجتاز تقييمه في 10 أيام. تساعد هذه الأداة، الفريدة لـ Atlas Funded، المتداولين الهنود على إدارة المخاطر بفعالية، وهي ميزة غالبًا ما تكون مفقودة في شركات مثل FXIFY.

مدفوعات سريعة وسهلة الاستخدام

يعطي التجار الهنود الأولوية لعمليات السحب السريعة والتي يمكن الوصول إليها. تقدم Atlas Funded دفعات شبه فورية في غضون أيام، مع عدم وجود حد أدنى للسحب، وتدعم INR عبر منصات مثل Wise و Payoneer. يصل تقسيم الأرباح الافتراضي بنسبة 80٪ إلى 95٪ مع إضافة، متفوقًا على المنافسين مثل DNA Funded (حتى 90٪ مع دفعات أبطأ). تضمن هذه المرونة للمتداولين الهنود إعادة استثمار الأرباح بسرعة.

المجتمع والدعم مصممان للهند

ديسكورد من شركة أطلس فيوند يعزز المجتمع، الذي يضم الآلاف من المتداولين العالميين والهنود، التعاون في استراتيجيات مثل تداول الدولار الأمريكي/الروبية الهندية خلال تداخلات لندن. تتناول ندوات الويب الأسبوعية موضوعات خاصة بالهند، مثل الامتثال لـ SEBI وتقلبات NIFTY 50. يضمن فريق الدعم الذي يعمل على مدار الساعة طوال أيام الأسبوع، والذي أشاد به المتداول روهان على TrustPilot، حلًا سريعًا للاستفسارات، وهو أمر بالغ الأهمية للمنطقة الزمنية للهند.

كيف يقارن Atlas Funded بشركات الدعم الأخرى للتجار الهنود

الوجبات السريعة الرئيسية:

- ممول بنظام أطلس تتفوق في التحدي المكون من خطوة واحدة، والمدفوعات الصديقة لـ INR، وتقسيمات الأرباح العالية (حتى 95٪)، وهي مثالية للمتداولين الهنود.

- تم تمويله بعد ذلك تقدم منصات مرنة ولكن دفعات أبطأ ونماذج تحدي معقدة.

- أصلحه يوفر تمويلًا فوريًا ولكنه يفرض رسومًا إضافية على التخصيص.

- ممول من الحمض النووي تفتخر بأصول متنوعة ولكنها تفتقر إلى خيارات الدفع الخاصة بـ INR.

- ثينك كابيتال مناسب للمبتدئين ولكن لديه تقسيمات أرباح أقل.

إن تركيز Atlas Funded على القدرة على تحمل التكاليف والميزات الخاصة بالهند يجعله الاختيار الأفضل لعام 2025.

كيف يمكن للتجار الهنود النجاح مع Atlas Funded

الخطوة 1: حدد التحدي المناسب

اختر تحدي Single Helix للمرونة أو تحدي Pro للحصول على تمويل أسرع. تتناسب أحجام الحسابات من 5,000 دولار إلى 200,000 دولار مع ملفات تعريف المخاطر المختلفة.

الخطوة 2: استخدم لوحة التحكم الخاصة

استفد من التحليلات في الوقت الفعلي لتتبع التداولات، خاصة خلال الجلسات عالية التقلب مثل ارتفاع الدولار الأمريكي/الروبية الهندية. قامت Trader Priya بتحسين تداولاتها المشفرة باستخدام لوحة القيادة، وتجنب انتهاكات السحب.

الخطوة 3: تحسين استراتيجيات التداول

ركز على الأصول مثل الدولار الأمريكي/الروبية الهندية أو NIFTY 50، باستخدام الرافعة المالية 50:1 من Atlas Funded. استخدم إدارة المخاطر (1-2٪ لكل صفقة) واختبر الاستراتيجيات على الحسابات التجريبية لتتماشى مع ساعات السوق في الهند. تسلط اتجاهات X الأخيرة الضوء على تقلبات العملات المشفرة، مما يجعل BTC/USD هدفًا رئيسيًا.

الخطوة 4: الانخراط مع المجتمع

انضم إلى Discord من Atlas Funded لمشاركة استراتيجيات تداول NIFTY 50 أو أزواج العملات الأجنبية. تقدم الندوات عبر الإنترنت رؤى حول الامتثال لـ SEBI وإدارة المخاطر للمتداولين الهنود.

الخطوة 5: توسيع نطاق حسابك

تعمل خطة التوسع الخاصة بـ Atlas Funded على زيادة أحجام الحسابات بنسبة 25٪ عند تحقيق أهداف الربح بنسبة 10٪، مما يسمح للمتداولين الهنود بالنمو من 10,000 دولار إلى 50,000 دولار أو أكثر.

لماذا يختار التجار الهنود Atlas Funded في عام 2025

تكمن القيمة الفريدة لـ Atlas Funded في نهجها المتمحور حول الهند:

- دخول ميسور التكلفة: تبدأ التحديات من 4,800 دولار، ويمكن للمتداولين الهنود الوصول إليها.

- قواعد مرنة: لا توجد قيود على المضاربة أو EAs أو تداول الأخبار.

- دفعات صديقة للبيئة: عمليات سحب سريعة عبر Wise و Payoneer.

- أدوات متقدمة: لوحة تحكم خاصة وتكامل TradeLocker.

- دعم المجتمع: ندوات عبر الإنترنت مصممة خصيصًا وديسكورد نابض بالحياة للمتداولين الهنود.

تؤكد الشهادات، مثل نجاح Arjun مع NIFTY 50، على موثوقية Atlas Funded، مما يجعلها شركة دعم موثوقة للمتداولين الهنود في عام 2025.

أسئلة متكررة

.svg.webp)

.png)